Tax write-offs are a method of reducing your taxable income or increasing the expenses you can subtract from your taxable income. Both individuals and businesses can claim tax write-offs on various expenses. For example, as a small business owner, you need to report your income through a system of revenue and losses or write-offs — the money you spend on specific expenses over the tax year. Those losses reduce your taxable income for the year.

Though a tax deduction and tax write-off are the same, some experts may speak of write-offs for businesses and tax deductions for individuals. Either way, tax write-offs are significant to individuals and small business owners because they can result in significant cost savings. Learn more below about what you can and can’t deduct and how consulting with a tax professional can streamline the process while earning you greater deductions.

How Do Tax Write-Offs Work?

While learning about tax write-offs, it’s important to note that tax write-offs and tax credits are two different benefits. Tax credits directly reduce the taxes you owe, while tax deductions help you claim back on your taxable income.

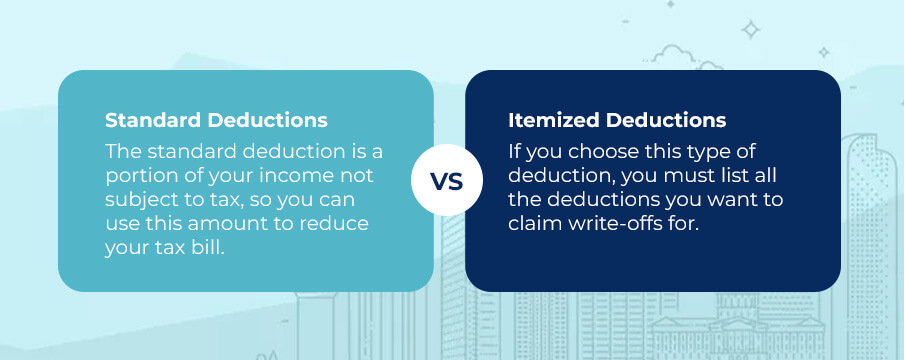

There are two ways to claim tax deductions when you fill out tax returns — making standard deductions or itemizing your deductions. Understanding the difference between standard and itemized deductions is vital because you have to choose between them.

Standard Deductions

The standard deduction is a portion of your income not subject to tax, so you can use this amount to reduce your tax bill. The Internal Revenue Service (IRS) sets the annual dollar amount for the standard deduction. Most taxpayers can choose this automatic deduction. With the standard option, you don’t need to sort through countless bank statements and receipts to itemize expenses, making it a straightforward choice.

If you opt for the standardized deduction, the IRS will automatically reduce your taxable income by the set amount for the year. Remember that this amount is based on your tax bracket and filing status.

Itemized Deductions

Itemizing items is a more involved process. If you choose this type of deduction, you must list all the deductions you want to claim write-offs for. You must also fill out a specific form — Schedule A — and keep records to support all the deductions you itemize.

While it takes more time and effort to organize your taxes this way, it can be worthwhile. If you itemize and keep good records, you can lower your taxable income more than you would by choosing the standard deduction.

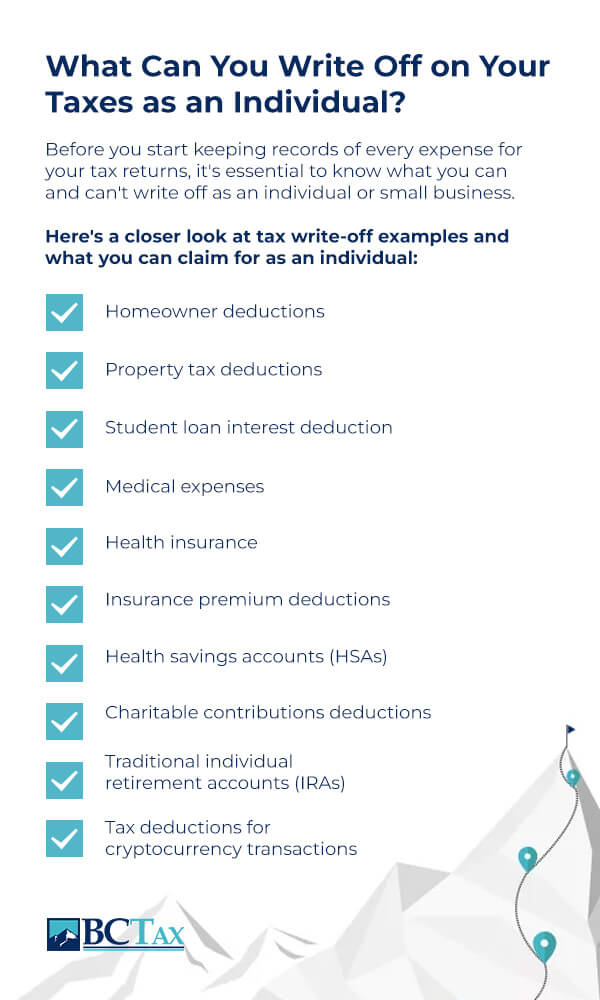

What Can You Write Off on Your Taxes as an Individual?

Before you start keeping records of every expense for your tax returns, it’s essential to know what you can and can’t write off as an individual or small business. Some expenses you can deduct are obvious, such as business travel expenses or deductions for medical expenses. Other deductions, like writing off cryptocurrency losses, may be more surprising.

Here’s a closer look at tax write-off examples and what you can claim for as an individual:

- Homeowner deductions: You can deduct the interest you pay on your mortgage from your taxes, but you can only claim a write-off for interest on up to $750,000 of debt you incurred after December 15, 2017, or half that amount if your filing status is married filing separately.

- Property tax deductions: You may itemize your tax returns to deduct property taxes you pay on your primary residence and any other real estate you own.

- Student loan interest deduction: Student loans can be a burden, but thankfully, you can enjoy tax write-offs to help you manage your debt payments. You can write off up to $2,500 from your taxable income if you’ve paid interest on your student debt.

- Medical expenses: There are several qualified health care items you may be able to include in your deductions, though you have to itemize them. You could add doctor’s and dentist appointments, therapy sessions, prescriptions, prescription eyeglasses and even travel costs to and from appointments. Additionally, you may be able to deduct for accessibility changes you made to your house, such as adding a wheelchair ramp.

- Health insurance: The process is slightly different for health insurance costs. You can deduct your out-of-pocket health insurance premiums without having to itemize other expenses if you’re self-employed. However, if you’re employed by a company and pay some or all of their plan’s premiums, you need to itemize to be able to deduct. The same goes for any other health insurance premiums you pay.

- Insurance premium deductions: Surprisingly, many missed deductions are related to insurance premiums. Consulting with a tax expert can help you sort through your premiums to determine which qualifies for deductions.

- Health savings accounts (HSAs): An HSA is a type of personal savings account set up for specific health care costs. All HSA contributions are tax-deductible up to the maximum the law permits — even if you don’t itemize. Chat with your tax expert to understand how deductions will differ if you have a self-coverage plan or family coverage and if your employer contributes to your HSA.

- Charitable contributions deductions: Some philanthropic contributions are tax-deductible. You must donate to a qualifying, IRS-recognized charity — check that they have a 501(c)(3) status to avoid complications when you want to claim. You also can’t receive anything in return for your donations if you want to be able to deduct. Generally, you can deduct 20% to 60% depending on the organization and your contribution. You need to itemize your taxes to claim back for charitable donations.

- Traditional individual retirement accounts (IRAs): Though anyone qualifies to make contributions to a traditional IRA, deductions for donations aren’t available. You may not be able to deduct depending on the type of plan you contribute to, like a 401(k), and if your modified adjusted gross income is above annual limits.

- Tax deductions for cryptocurrency transactions: If you’ve invested in crypto, it’s good to know that you may be able to claim tax deductions since the IRS views crypto as property — rather than true currency — and that makes buying, selling or exchanging crypto taxable. Chat with your tax consultant to understand how your gains and losses affect your taxes.

What Can You Write Off as a Small Business?

Small companies and corporations can enjoy a number of business tax write-offs, and self-employed individuals and independent contractors can do the same through 1099 write-offs. Note your write-offs when you sit down to calculate your profits for the year and report your revenue and spending.

It’s important to keep a couple of points in mind about business expense write-offs. First, you must keep a record of all your income and expenses, as you’ll need these documents to support your deductions. Additionally, though several expenses may be necessary for your business, the IRS only allows tax deductions for specific expenses.

Some of the items and services your business may be able to claim include:

- Home office tax deductions: Do you work from home? Home-based small companies and freelancers could be eligible to enjoy home office tax deductions if they use part of their home as their principal place of business consistently. You must use the area — up to 300 square feet — exclusively for business.

- Office supplies: Keep receipts for all your office supplies, including pens, paper, software, technology and even work-related postage costs, so you can claim within the year you purchase these items.

- Advertising and marketing expenses: You can deduct various expenses for marketing your business, from business cards and print advertising to web design.

- Salaries and employee benefits: You can write off your employees’ wages, vacation pay and benefits as a small business. To do so, you must meet specific requirements, including showing that the salaries paid are necessary and fair. If the employee is a partner in the business, a sole proprietor or an LLC member, you can’t claim deductions on salaries and benefits.

- Utility, phone and internet bills: Keep track of all spending for utilities and your phone and internet bills, as these are essential for running a business and, therefore, completely tax deductible. Note that if you use the same phone and internet for personal and professional use, you can only deduct the percentage of the cost you use for business.

- Company vehicle: If you have a vehicle you use solely for business, you can write off all costs. However, if you have a car you use for personal and business use, you can only claim a percent of the costs related to business use.

- Business meal expense deductions: To qualify for meal deductions, you must keep records of the date, location and total cost of the meal and your professional relationship with your dining companions — receipts and bills work well. The cost of the meal or drinks should not be what most would consider extravagant. Maintaining these records could deduct up to 50% for qualifying foods and drinks.

- Work travel: Itemize all your work-related travel expenses to get the most from your tax deductions. These expenses include rental cars, airfare, accommodation, meals and more. Travel must be necessary for your business. Additionally, the trip must take you outside of the area where your company conducts usual business and must be long enough that it requires you to be gone from your business’s tax home for longer than regular working hours, requiring you to sleep or rest while you travel.

- Educational: Bettering your knowledge and skills is vital to growing a business. As a result, you can deduct for educational expenses such as webinars, industry-related educational books, subscriptions to trade publications and courses related to your field of work.

Expenses That Aren’t Tax Deductible for Small Businesses

While small businesses can benefit from many tax-deductible expenses, some expenses will not qualify, including:

- Certain penalties, legal fees or fines.

- Mileages for your daily commute to and from work.

- Political contributions.

- Personal and family expenses, such as sports, hobbies and leisure activities.

- Some types of insurance premiums.

- Charitable contributions.

- Club memberships.

- Everyday business attire — personal protective equipment may be tax deductible.

Advantages of Seeking Professional Advice on Tax Write-Offs

Filing your taxes and knowing what is or isn’t tax deductible can be complicated for individuals and small businesses alike. There are many advantages to consulting with a tax expert who can help you with your write-offs.

- Save time and money: While it costs money to hire a tax expert, they may be able to find tax deductions and credits you qualify for that you wouldn’t have known to claim on your own, making the investment worthwhile. Filling out tax forms can also take hours to do on your own. A professional can organize your documents in a much shorter time.

- Avoid tax errors: Making mistakes on your taxes can be costly. An expert can help you avoid common tax mistakes. Plus, a tax expert can advise you ahead of tax season and help you prepare, further reducing complications.

- Enjoy a stress-free tax experience: One of the significant advantages of having a tax professional on your side is that you enjoy peace of mind and less stress knowing an expert is handling your taxes.

Claim Tax Write-Offs With Help From BC Tax

Preparing for tax season and getting the most out of your tax write-offs saves you money. Though there are many guidelines and regulations to follow for tax deductions, following them helps you receive the most you can — and a tax expert can help you do that without the stress.

At BC Tax, we’re always ready to assist you with your tax deductions, no matter how complex your finances may seem. Our team of experts has helped individuals and businesses across the country with an array of tax services and solutions, ensuring they understand their taxes and streamlining their tax processes to ensure compliance and notable returns.

Want to learn more about our services and how we can help you get the most from your deductions this tax season and beyond? Contact us today to schedule a free consultation.

1-800-548-4639

1-800-548-4639