Everyone who lives or works in the United States is responsible for paying taxes. Taxes can be a major source of stress for many individuals, but they don’t have to be. With proper tax planning, you could reduce your tax burden or earn a larger refund at the end of the year. Without these insights, many taxpayers miss potential tax benefits and may end up paying more than necessary.

It’s critical to anticipate taxes as you create a financial plan. Thoughtful tax planning is vital for any wealth-management strategy. It can help you save for your child’s education or a retirement fund, grow your small business, maximize your income, and protect you from legal penalties, among other advantages. Read on to learn about the importance of tax planning, what it entails, its potential benefits and how to get started.

Table of Contents

- What Is Tax Planning?

- Different Types Of Tax Planning

- Benefits Of Tax Planning

- Planning Ahead For Tax Day

- Contact BC Tax For A Free, No-Obligation Consultation

What Is Tax Planning?

The definition of tax planning is simple. It entails analyzing your financial situation so you can minimize your tax liability. It allows you to owe less and earn back more. At the end of tax season, it can result in hundreds or thousands of dollars in your pocket, depending on your situation.

The significance of tax planning is that it’s a vital aspect of financial planning for individuals, families or businesses. Proper planning enables you to understand which tax benefits you qualify for. Here are some of the main reasons why tax planning is important:

- Deductions: Tax deductions allow you to reduce your taxable income. They’re usually expenses you incur all year round, which you can subtract from your total income. A deduction might include a charitable donation.

- Rebates: Rebates are a form of refund that occurs after a retroactive tax decrease. Congress sometimes offers rebates to help stimulate the economy during financial recessions. They’re also used to incentivize environmentally friendly practices.

- Credits: Credits allow you to subtract from the total you owe. If you’re a student, from a low-income family or you have children, you may qualify for a tax credit.

- Concessions: A tax concession is a government reduction in the amount a certain group of people owes. They’re usually used to incentivize certain behaviors.

- Exemptions: Exemptions reduce or eliminate someone’s responsibility to pay. If you have dependents who rely on you financially, dependent-related exemptions lower your taxes by a certain amount for each child or other relative under your care.

Anyone who’s liable to pay taxes should consider tax planning. That includes low- to medium-income individuals, parents, those near retirement, small businesses and massive estates. Without tax plans, you may end up paying more than necessary or not saving as much as you could.

Different Types of Tax Planning

The four basic types of tax planning include:

- Federal income tax planning: It’s wise to plan your federal income taxes. Federal income tax deductions might include student loan interest, college savings and charitable donations. Credits might include a child tax credit, an earned income tax credit or an American Opportunity tax credit.

- Retirement tax planning: With proper planning, you can reduce your tax liability and maximize your income post-career. This involves the best utilization of an individual retirement account or 401(k) plan and careful calculation of your Social Security benefits.

- Estate tax planning: When someone passes away, their estate may be subject to federal estate taxes. Those who fall into this category require estate tax planning to preserve their estate’s value. Some states also demand an estate tax, sometimes at lower value thresholds.

- Small business tax planning: Small businesses and self-employed workers have unique tax responsibilities. Applying the right deductions is critical. For instance, if you work out of a home office, you may be eligible for a deduction. You might also deduct the cost of vehicles, office equipment, travel and other business-related expenses. If you’re starting a new business, it’s important to take advantage of any tax relief.

Advantages of Tax Planning

Tax planning has many short-term and long-term benefits. The main short-term benefit is more money in your pocket after tax season. Some of the long-term advantages of tax planning might include any of the following, depending on your situation:

- Solving tax issues: If you owe back taxes or have other tax issues, planning can help you address these concerns and find a solution.

- Building a college fund: Tuition costs have risen exponentially in recent decades. If you want to build a college fund for your child, you can take advantage of the American Opportunity Credit to help you minimize future education expenses.

- Supporting your business: Starting or sustaining a business is challenging for many reasons — tax liability need not be one of those reasons. With small business tax planning, you can boost your business and accumulate more resources for growth.

- Saving for retirement: Your retirement contributions can grow tax-free over time, resulting in a sizable nest egg for the future. Retirement might seem a long way off, but early planning is vital for a comfortable post-career life.

- Maximizing an estate: If you have an estate large enough to incur state or federal estate taxes, proper planning can make a notable difference in your family’s finances, reducing your liability.

- Securing more for your heirs: With thoughtful tax planning, you’ll have more to pass on to your heirs. You can also work to minimize your heirs’ inheritance tax liability, so they can keep more of your lifetime earnings.

The Do’s and Don’ts of Tax Planning

It’s normal to feel uncertain about the deductions you can claim and which forms to fill in. However, with a little bit of organization and a positive mindset, it will feel less overwhelming. Here are some best practices to keep in mind while planning for tax season.

Do’s

The following actions will help ease the tax planning process:

- Familiarize yourself with tax laws: Getting to know the terms and know-how will help ease tax planning. Some tax laws and regulations change every year, so it’s essential to stay updated.

- Stay organized: Have a system in place where you can keep all your tax-related paperwork so that when it comes to filling in forms, you won’t have to rummage around multiple places. Try to keep personal and business-related paperwork separate.

- Invest in bookkeeping software: On top of keeping everything organized, using a bookkeeping program can make your life easier and tax season more efficient.

- File both federal and state taxes: Filing taxes can be a tedious task, so it can be more practical to file state and federal taxes at the same time.

- Choose the correct filing status: One of the most common mistakes is choosing the incorrect filing status, which can lead to an incorrect tax bill. If you’re unsure which of the five filing status categories you fall into, use the Internal Revenue Service (IRS) interactive tax assistant or ask your tax consultant.

- Ask for help: If your tax preparations are complicated, it may be beneficial to hire a professional to ensure you don’t miss any deductions or expenses. Plus, if you run a business, you can add tax service providers as another deduction!

Don’ts

If you prefer to keep headaches and last-minute panic sessions away, avoid the following:

- Ignoring due dates: Make sure you know the filing deadlines applicable to you. The closer to the due date you start preparing your taxes, the more likely you are to make mistakes or miss deductions and exemptions.

- Forgetting about all sources of income: You need to declare all extra sources of income, from the earnings of your day job and capital gains to the extra funds you get from your side hustles and investments.

- Losing sight of all possible deductions: Find out what exactly you can deduct from taxes in your personal life and for your business, as these lower the amount of income subject to taxation. Ask a tax practitioner for help if you’re unsure so you can reduce tax liability as much as possible.

- Using last year’s numbers exactly: Some amounts may stay the same year after year, but things do change on most items, such as business profits. Getting married or having a child are also major changes that could affect your tax returns.

- Guessing the numbers: Keeping a filing system, whether physical or online, will help you know the exact amount of income, charitable donations and business expenses you had in a tax year. Filing incorrect numbers could delay your tax refund.

Now that we covered the best practices, it’s time to explain how to get started.

Planning Ahead for Tax Day

Preparation is probably the most important of tax planning processes. Creating a plan for tax day can make a difference in your finances, solve tax-related issues and minimize your liability. If you’re new to tax planning, you’ll need to know how to get started. Tax planning might seem complicated and overwhelming at first glance, but the following steps can help simplify the process.

1. Gather All the Documents You Need

Whether you’re planning to do your taxes yourself or hire a professional, you’ll need some documents and information at the ready. Use this tax preparation checklist to ensure you have everything you need before filling in forms.

Personal Information

This tells the IRS everything they need about the person who’s filing taxes:

- Identification numbers: ID numbers can include Social Security or tax numbers and dates of birth for you, your spouse and your dependents, including children or elderly parents under your care.

- Last season’s tax return: These are not required but are helpful for knowing what documents you need and what you filed last time.

- Identity protection (IP) PIN: If an IP PIN was issued to you, your spouse or your dependents by the IRS, have it on hand.

- Bank account number: The number should correspond to the account where you want refunds to be deposited.

Income

Any kind of income you receive may include:

- Work: Employers issue this on your W-2 form.

- Business: Business income includes profit/loss statements and capital equipment information.

- Contract or freelance work: These documents may include invoices for products you sold or services you provided.

- Rent: Rental property income, including statements, are part of the income category.

- Dividends: Dividends are paid from stocks or shares.

- Interest: Interest received from investments counts as income.

- Additional payments: Payments include money you receive as alimony, royalties, prizes and rewards, or scholarships. It also includes money from trusts or jury duty.

Deductions

Here are some popular tax deductions that will help reduce your taxable income:

- Medical bills: You might be able to deduct medical bills and dental expenses.

- Property: Property taxes, mortgage interest and private mortgage insurance are also possible deductions.

- Retirement: Contributions made to an IRA or self-employed retirement account can be deducted.

- Education: You can deduct student tuition fees and student loan interest.

- Classroom: Money spent on classroom supplies as an educator can be deducted.

- Donations: Deductions may include cash, charity receipts, the value of donated items, miles driven or other expenses for registered charities.

- Home office: To deduct home office supplies, you must show records proving the expenses related to your business based from home.

- Rent: You can deduct any expenses related to your rental property.

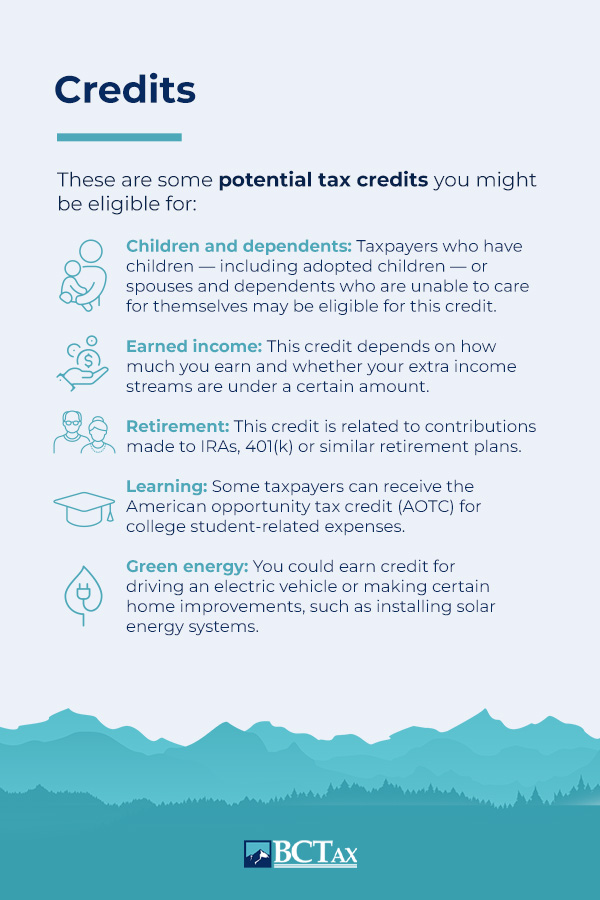

Credits

These are some potential tax credits you might be eligible for:

- Children and dependents: Taxpayers who have children — including adopted children — or spouses and dependents who are unable to care for themselves may be eligible for this credit.

- Earned income: This credit depends on how much you earn and whether your extra income streams are under a certain amount.

- Retirement: This credit is related to contributions made to IRAs, 401(k) or similar retirement plans.

- Learning: Some taxpayers can receive the American opportunity tax credit (AOTC) for college student-related expenses.

- Green energy: You could earn credit for driving an electric vehicle or making certain home improvements, such as installing solar energy systems.

Taxes Already Paid

This section is essential if you make multiple tax payments. Make sure you have a paper trail of the following:

- Federal estimated tax payments

- State and local income taxes paid

- Personal property taxes

- Vehicle license fees

2. Review Your Tax Return

You may think reviewing your tax return from the previous season is of little tax planning importance, but if you take a close look, you will see it details almost everything you need to evaluate your financial situation. You might need expert assistance to help you map out future choices. Nevertheless, here’s a quick guide for interpreting your tax return:

- Page 1: On the first page of your tax return, you’ll find your basic demographic information. Double-check this to make sure everything is up-to-date and accurate.

- Lines 6a through 6d: This section documents your exemptions, including dependents. Make sure your exemptions make sense and none are missing.

- Line 7: This includes any wages earned from traditional employment, including any W-2s. Those who are retired might find this line blank.

- Lines 8a through 8b: These lines document any interest payments you’ve received and reported through a 1099 interest form, including interest from bank accounts or investments.

- Lines 9a through 9b: Here, you’ll find any dividends you received from investments, found on a 1099 dividend form.

- Line 10: This includes the state refund from the previous tax year.

- Line 12: This line shows income from a business you own or your earnings if you’re self-employed.

- Line 13: Line 13 shows any capital gains from the previous year. This number can be positive or negative.

- Lines 15a through 15b: You’ll need to take note of this section if you’re retired. It includes income you received through retirement plan distributions, found on a 1099 retirement form.

- Lines 20a through 20b: This is your Social Security income, which can incur taxes.

- Line 22: Your total income is found on line 22.

- Lines 23 through 35: Here, you find any income subtractions, including health savings account deductions.

- Line 40: This subtracts a standard deduction or itemized expenses.

- Line 42: This subtracts any exemptions.

- Line 43: Line 43 shows your taxable income, which is your total income with all subtractions applied. You can use this number to find what tax bracket you’re in.

- Lines 64 through 74: This shows how much you paid in federal income taxes throughout the year, including withholdings or estimated payments. If you overpaid, you’ll receive a refund.

- Line 76 through 77: Here, you’ll have your refund paid if you qualify for one. You can apply it right away or on the next year’s tax returns.

- Lines 78 through 79: These lines show any tax bills that you have to pay by the filing deadline to avoid a penalty and interest.

3. Fill in the Forms Applicable to You

Before you can start tax planning, you’ll have to gather all the necessary tax-related forms. They’ll help you identify your situation and any possible tax advantages. In addition to your tax return and W-2s, gather each of the following documents, if applicable:

- 1040 tax form: The 1040 tax form is a standard individual income tax return form needed to file your tax returns. It calculates your total taxable income, determining how much you need to pay or how much the government owes you in refunds.

- 1099 tax form: A 1099 miscellaneous form includes miscellaneous payments or self-employment income for independent contractors. It includes payments for rent, prizes, fishing boat proceeds, medical and health care payments, payments to an attorney and other miscellaneous payments.

- K-1 tax form: The K-1 form allows business partners to report their share of the earnings, losses, credits and deductions involved with the partnership. It divides taxable income to each partner according to their share of the business. For instance, two equal partners with a business that earned $100,000 will each receive a K-1 form showing a taxable income of $50,000, which they’ll need to add to their own tax returns.

- W-4 tax form: The W-4 tax form, also called an Employee’s Withholding Certificate, tells your employer how much federal income tax to withhold from your salary. You can request additional taxes withheld from each pay to reduce your burden come tax season. It’s best to consult with a professional to determine whether or not this is a good idea for you.

- Tax extension form: If you need to request a time extension for filing your federal income tax return, you’ll use the tax extension form. The government may also postpone the filing deadline in the case of a nationwide economic crisis. You may qualify for an extension if you’re out of the country. Keep in mind that the IRS still charges interest, even if you qualify for an extension. You may also owe penalties if you cannot prove your inability to pay on time.

- I-9 tax form: Employers file I-9 forms, which verify employee identity. Every United States employer is responsible for an I-9 form for each employee, both citizens and non-citizens. The employee has to prove work authorization using acceptable documentation.

- W-9 tax form: The W-9 form, similar to the I-9 form, verifies independent contractor identities. Business owners use them to gather all legal information from the independent contractors they hire.

- 1040-ES form: The 1040-ES form allows you to determine and pay your estimated tax, which is for income not subject to withholding, including self-employment earnings, interest, dividends, alimony, rents and other sources. If you opt out of voluntary withholding, you should make estimated tax payments.

4. Consult Tax Experts

All these forms and details provide lots of information. Interpreting the information can be difficult for anyone who is not a professional tax accountant. The fine print may be hiding credits, deductions or other tax benefits you’ve missed. Even if you feel well-versed in tax-related lingo, it could benefit you to confer with a professional tax service. A tax consultant can help you solve tax issues, maximize your earnings and minimize your liability. This could be a substantial advantage for you and your family.

If you need help with back taxes or have other concerns, a tax consultant can help decrease the burden on your shoulders. They can work to slow down the collection process, lessen the penalties you’ve accrued and create an affordable payment plan. They’ll communicate with the IRS to formulate the best possible solution for you.

A consultant can also help you implement the best tax plan for you, your business or your family. They’ll recognize which tax benefits you’re eligible for. They can help you reduce the amount you owe or earn a larger refund. Tax planning is not just for those with large estates or huge, lucrative businesses — it’s for anyone who wants to make the most of their earnings.

Contact BC Tax for a Free, No-Obligation Consultation

Consulting with an expert as part of your tax planning can help you avoid legal penalties, start a college fund for your child, put away money for retirement, grow your small business and improve your quality of life. If you’ve yet to invest time into tax planning, you may want to start as soon as you can.

If you’re ready to maximize your earnings and minimize tax liability, consider BC Tax. At BC Tax, we offer tax relief, tax planning, account protection and bookkeeping services. We can help reduce tax-related stress and create a plan that serves your needs. With the help of our tax experts, you can work towards your financial objectives with confidence. To learn more, contact BC Tax today for a free, no-obligation consultation.

1-800-548-4639

1-800-548-4639