Taxes help your government pay for necessities and amenities you may not even consider. For example, taxes generally pay for maintaining infrastructure and running the public school system. Failing to pay taxes is illegal and can have severe consequences for you as an individual or for your business.

If you don’t understand how different taxes work or aren’t aware you’re liable for certain taxes, you might not pay your taxes unintentionally. An expert, like BC Tax, can help you understand the ins and outs of taxes.

This article covers the differences between sales tax and use tax. Learn their definitions, who pays these taxes and how to file if you need to pay.

What Is Sales and Use Tax?

Different kinds of taxes exist. Even if you don’t understand them all, you must still pay your taxes and file the relevant returns.

Sales and use tax might sound similar, but they have several significant differences. Here’s how sales and use tax differ:

What Is Sales Tax?

Sales tax is a tax businesses collect from their customers. Under state laws, companies must collect a tax on the sales of certain goods and services. The tax amount is a percentage of the total cost of the taxable product or service.

Whether businesses have to collect sales tax or not is based on nexus, which is a relationship between a business and the state. A company may have nexus based on their location or the amount of money they make. If a business has nexus, it must collect sales tax and remit the amount to the state.

Sales tax is mostly set at the state level, so rates vary from state to state. Some states don’t charge sales tax at all. Most states that have sales taxes also allow local governments to charge local sales taxes. Sales tax rates can also vary for different categories of products, such as low or no sales tax for food and higher sales tax for tobacco products and alcohol.

What Is Use Tax?

Use tax applies to taxable goods and services when the seller doesn’t collect sales tax. Generally, if the buyer paid sales tax, they don’t pay use tax. When companies do not collect sales tax on taxable products or services, purchasers must pay use tax on the goods to the state directly.

Consumers and businesses must pay use tax when they buy products or services from sellers that aren’t required to charge sales tax or in a different location to use in a taxing state. Businesses must also pay use tax if they consume taxable goods or services that they bought tax-free or for resale.

Many online businesses do not collect sales tax. Therefore, the buyer is responsible for paying taxes to the state where they’re located. Use tax also applies to products purchased in another state or country. If a traveler buys souvenirs in a state that doesn’t impose sales tax, they must pay their home state for those costs.

Examples of Use Tax vs. Sales Tax

Here are some examples of sales and use tax in action:

Examples of Sales Tax

Businesses with a sales tax nexus must collect taxes based on the state’s rate and any additional local taxes. For instance, if a company operates in a state with a rate of 5% and a city rate of 0.75%, it must impose a 5.75% sales tax on the sale of certain goods and services. If you purchase an item or receive services from this company, you pay the sales price and the tax. The company collects taxes on all its sales and pays the state a lump sum.

Examples of Use Tax

Suppose you purchase a product from an out-of-state shop that does not charge sales tax. A company may not charge sales tax if it’s located in a state without sales tax or doesn’t have nexus where you live. Even though you don’t pay sales tax to the business, you must pay use tax in your home state if it charges sales tax. If you live in a place that doesn’t charge sales tax, you won’t pay use tax.

Use tax is also for services. Say you need to get your vehicle repaired while you’re on a road trip. If you have these repairs done in a state that doesn’t charge sales tax, but your home state charges sales tax for services of this type, you owe use tax in your home state for the repair service.

The Main Differences

Sales and use tax aren’t the same thing, although both are for services and the consumption of goods. Another one of the similarities between the two is there are exemptions to what states can tax, such as medicine, food and some kinds of equipment. The taxes are for the state and the local government to pay for their programs, services and infrastructure, such as roads and sewers.

The primary difference is that businesses collect sales tax when a customer makes a purchase, while buyers pay use tax directly to the state.

When customers purchase taxable goods from an organization with nexus and can collect sales tax, they immediately charge customers the required amount. For instance, if a customer purchases a taxable product for $10 and the state sales tax is 7.5%, they pay $10.75 at the time of the sale. When businesses collect sales tax, they pay the funds they collect to the tax agencies later.

With use tax, buyers still pay taxes when they purchase products, but they don’t pay it immediately. Instead, they calculate use tax on taxable purchases based on the rate the state and local governments impose where they live and pay the amount to the state. For example, suppose a customer spends $10 on a product while visiting a state that doesn’t charge sales tax and brings the item back to their home state, which charges a 6% sales tax. In this case, the customer owes their home state $0.60 in use tax.

How to File Sales and Use Taxes

The process of filing both sales and use tax is relatively simple. However, before you can file the taxes, you must understand how to calculate sales and use tax.

Sales Tax

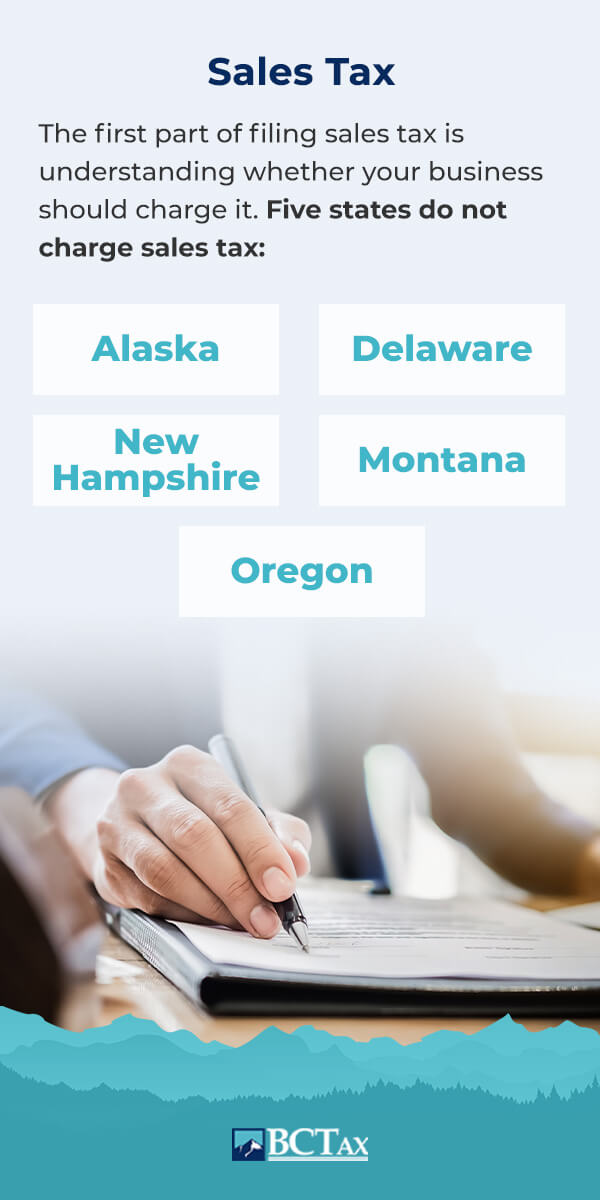

The first part of filing sales tax is understanding whether your business should charge it. Five states do not charge sales tax:

- Alaska

- Delaware

- New Hampshire

- Montana

- Oregon

Note that several jurisdictions in Alaska levy local sales taxes, so your company may still need to pay sales taxes.

Tax nexus determines whether a seller can collect sales tax. Every state has different criteria for nexus, but they generally include transaction thresholds, economic nexus, physical presence and business-related activities. If there is a nexus, your area will have its own sales tax rate.

Once you have determined your business has nexus and should charge sales tax, you must register with the state’s tax agency to start collecting it. You also need to document all invoices for sales tax. The due date and filing frequency for submitting your taxes and the transactions you collect tax on varies by state. Some require payments as frequently as monthly based on your sales. Other states only require one annual payment.

Use Tax

Use tax can be more difficult to calculate, depending on where you live. Some states include shipping and handling charges when calculating sales or use tax, while others don’t.

You can file use tax in various ways, depending on the state where you owe. Your approach will depend on your tax liability and whether you have a sales tax license. Most states offer an online electronic option for filing and paying.

In most states, consumers report use tax on their state income tax returns. States without a state income tax typically have a separate form to file for use tax. Businesses that owe use tax generally report it on their sales tax forms but should check with the state tax authority if they don’t have a tax permit. Avoid playing the guessing game when planning your tax returns, as you could face late penalty fees.

What Is a Taxable Purchase for Use Tax?

There are various items where use tax can be imposed for businesses. Here are some examples of common taxable purchases:

- Utility costs from water, gas or electricity.

- Taxable services include building cleaning and maintenance, garden care and security services.

- General items include cleaning supplies, furniture, office equipment, computer software and hardware.

There are also some services where consumers can end up paying the rate, including:

- Vehicle fees for rental, repairs or towing

- Personal services, such as tattooing, tanning, spa services, personal training

- Recreational services, including tickets to sporting events, sightseeing trips and fishing charters

- Miscellaneous services, such as catering, alarm monitoring services, car washes or telephone services

- Construction services, such as improving existing or new building structures, cleaning or decorating personal property

Frequently Asked Questions

Managing and understanding sales and use tax takes work as different factors are involved. Here are the answers to some common questions about sales and use tax:

What States Impose Use or Sales Tax?

Forty-five states impose use or sales tax, but five do not. As noted above, there are no sales or use taxes in Alaska, Delaware, New Hampshire, Montana or Oregon. However, local municipalities in these five states can charge local sales tax. For example, many jurisdictions in Alaska charge sales tax, while Oregon charges taxes for temporary lodging.

Is There a Standard National Sales Tax?

In the United States, there is no national sales tax. Instead, each state sets its own sales tax rate. States with the lowest combined state and local sales tax rates are Alaska, Hawaii, Wisconsin, Wyoming and Maine. The states with the highest rates are Tennessee, Louisiana, Arkansas, Washington and Alabama.

Do States With a Sales Tax Have a Use Tax?

Yes, every state with a sales tax has a complementary use tax. In most states that have sales tax, the use tax is the same rate. However, some states have different rates. When they differ, the use tax rate is generally lower.

How Does a Business Know How Much Sales Tax to Collect?

Most states use destination sourcing to determine where a sale takes place, which means the sale location is based on where the customer is. If businesses have nexus in the customer’s location, they charge the customer the sales tax rate for that location.

A few states use origin sourcing to determine where a sale takes place, which means the sale location is based on where the seller is or ships the order rather than where the buyer is. In this case, companies calculate sales tax for their location, regardless of where their customers are. Even fewer states use both destination and origin sourcing based on the transaction type.

What Is the Difference Between Economic and Physical Nexus?

There are two kinds of nexus — physical and economic. Physical nexus is when a business has a physical presence, such as a store, warehouse or office. Economic nexus focuses on the business’s economic activity. The company must collect and remit sales tax if its revenue meets a certain financial threshold.

How Do You Know How Much Use Tax to Pay?

To determine this amount, you need to know your state’s use tax rate and the amount you spent on taxable goods and services. Then you can calculate the use tax you owe. Note that in some states, the use tax rate includes additional fees like shipping costs in addition to the base sale price of an item.

Which Elements Must Be Included in the Sales Price?

When calculating sales price, businesses must include all the factors contributing to the final product. Factors such as the seller’s property cost, services they require to provide the product, delivery charges and material costs such as interest, labor and transportation fees contribute to the final sales price.

Can Resellers Charge Sales Tax?

Resellers still collect sales tax when consumers purchase the items they resell.

Are There Penalties for Failing to Pay Use Tax?

Failing to file a return on use tax when you are expected to will result in penalties. Over time, these penalties accrue interest until you fully pay off the amount. Therefore, it is best to ensure you comply.

Trust Our Tax Professionals for All Your Tax Needs

Sales and use tax have the same purpose — to generate revenue for the state or local government. The differences exist in who pays the taxes as businesses collect sales tax and customers pay use tax. Knowing the different sales tax rates states use allows you to remain compliant if you buy or sell items out of state or online.

Paying sales and use taxes is essential, and understanding how much you need to pay might be a lot of work. Luckily, professionals can help you with tax needs. Contact BC Tax today for expert advice on filing taxes.

1-800-548-4639

1-800-548-4639