Handling tax debt can sometimes feel like a complex matter to resolve. Fortunately, tax resolution specialists can guide you through basic and more complex tax concerns like tax audits, unpaid tax penalties and unfiled tax returns.

Tax resolution specialists aim to understand your unique situation, determine an effective solution and communicate with tax authorities on your behalf. They’re essentially the intermediaries between taxpayers and authorities like the Internal Revenue Service (IRS).

Enrolled agents (EAs), certified public accountants (CPAs) and tax attorneys are all tax specialists that may be able to assist you. Do you need a CPA, EA or tax attorney? This comprehensive guide explains the differences between enrolled agents, CPAs and tax attorneys and what situations require these professionals.

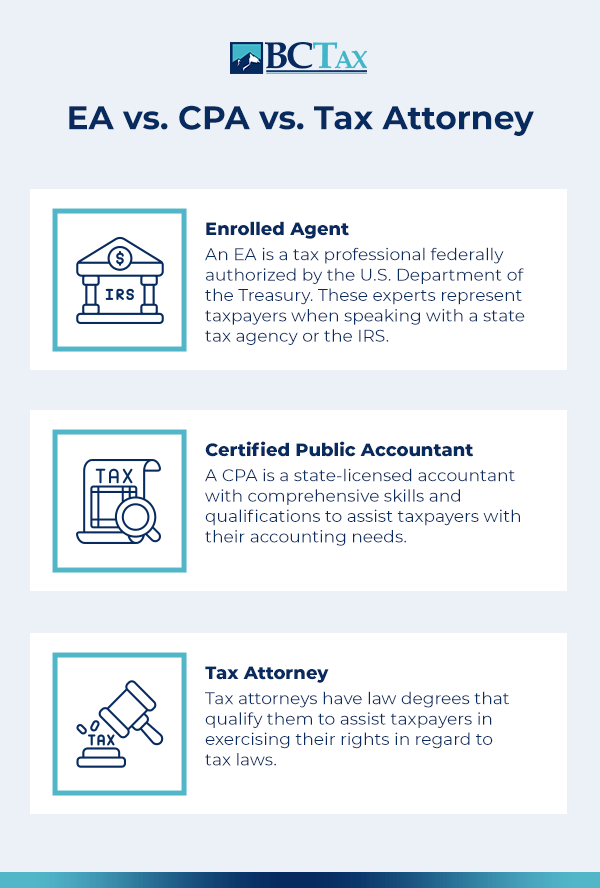

EA vs. CPA vs. Tax Attorney

After earning the relevant certifications, professionals like EAs, CPAs and tax attorneys can become qualified to offer tax resolution services. Still, the solutions they offer vary based on their specialties. Let’s explore the difference between CPAs, EAs and tax attorneys.

Enrolled Agent

An EA is a tax professional federally authorized by the U.S. Department of the Treasury. These experts represent taxpayers when speaking with a state tax agency or the IRS and help resolve issues, including collections, audits and appeals.

EAs gain their licenses by passing a comprehensive three-part IRS test about business and individual tax returns. Sometimes, an EA may become certified through their experience as a former IRS employee. These agents must take a 72-hour continued education course every three years to maintain their licenses. This helps them stay up-to-date on all the latest ethical and professional standards.

EAs offer one of the most cost-effective ways for small businesses and individual taxpayers to handle tax preparation, bookkeeping and small collection action items like appeals, levies and liens. They also have detailed knowledge of income tax, estate tax, inheritance tax, payroll tax and gift tax.

Certified Public Accountant

A CPA is a state-licensed accountant with comprehensive skills and qualifications to assist taxpayers with their accounting needs.

These professionals take 150 semester units of college education, have a full accounting degree, sit for licensing exams by taking additional graduate classes and pass state CPA exams. This education provides the technical skills needed to perform their job duties correctly. After one year of accounting-related experience, these professionals may qualify to be CPAs and continually in yearly education to stay updated on the latest tax laws and tax return preparation strategies.

CPAs may offer guidance to individuals and businesses in managing their finances, preparing tax returns and planning tax return strategies. They can represent taxpayers in a limited capacity.

Tax Attorney

Tax attorneys have law degrees that qualify them to assist taxpayers in exercising their rights in regard to tax laws. These tax professionals have a detailed knowledge of tax laws and may help you present your case to the U.S. Tax Court if needed.

Tax attorneys differ from CPAs and EAs in that they provide strict confidentiality. This means that regardless of whether you were in the wrong or right, you can freely communicate with your tax attorney, and they will protect that information when dealing with federal or state government tax entities.

Tax attorneys may help you with situations regarding transactional tax planning, trusts, wills, estate planning and tax controversy. Tax controversy involves helping with audits, appeals, collections and businesses or individuals engaged in criminal activities.

When to Reach out to an EA

Whether an EA can help you with taxes depends on your unique tax situation and what you need help with specifically. It’s best to speak directly with an EA about their capabilities. The EAs at BC Tax will typically ask about the specifics of your situation and use their knowledge of tax laws and IRS regulations to form an effective strategy.

Here are some situations that might call for you to work with an EA:

- Tax audit: Tax audits review and investigate an individual’s or business’s financial information and accounts. This unbiased evaluation verifies that your reported tax amount is correct. To help avoid issues and penalties, EAs can guide you through the process, offer support and ensure you follow all steps correctly.

- Unfiled tax returns: Unfiled tax returns often lead to penalties and additional interest from the IRS. If the process seems too complex, EAs can help you file these taxes and maximize your deductions to reduce your total amount owed.

- Unpaid tax penalties: When you avoid filing or paying your taxes, the IRS may charge you with tax penalties. The longer you put off paying your taxes and the penalties, the higher the penalty amount becomes. Working with a knowledgeable and experienced EA can help you identify opportunities to reduce your tax penalties and other costs under IRS regulations.

- IRS investigation: If the IRS decides to investigate you, it’s important to be prepared and know what questions they might ask and what documents they might request. An EA is well-versed in IRS rules and regulations, and some may even have been former IRS employees. This makes them an excellent asset to you because they can interpret your situation, prepare you and coach you through an investigation.

- Tax fraud: The IRS might accuse you of tax fraud if you underreport income, provide false information about claims or deductions, or claim credits wrongfully. If the IRS believes you committed tax fraud, an EA can assess your situation in detail, help you navigate the investigation process and potentially find opportunities to improve your case.

- Tax liens: Business owners or individuals may receive a tax lien claim against them if they fail to pay taxes on their property. An EA may be able to help you in this situation by analyzing your case and evaluating an effective course of action that may prevent the IRS from taking various collection actions or that will remove the tax lien entirely.

- Tax levies: A tax levy may be more serious than a tax lien because it requires the IRS to seize or take your property to make up for a tax debt you owe. Depending on how large your debt is, the IRS may continue to seize your assets until it covers the taxes, penalties and interest you owe. EAs know of various ways to stop this or reduce its impact, making it a good idea to seek help from a knowledgeable agent.

When to Reach out to a CPA

A CPA may be helpful to business owners because of their ability to assist in various situations. They can help you prepare important financial documentation and handle bookkeeping, tax filing and financial planning. They may also offer valuable financial advice that will allow your business to grow. However, CPAs cannot take on certain tasks, such as handling tax disputes. This is because their expertise lies in financial advice and accounting. Some common ways a CPA may assist you regarding taxes include:

- Bookkeeping: Bookkeeping plays an essential role in a corporation’s success. Accurate recordkeeping of finances provides the business owner with critical information about how the company is performing and where it can improve. CPAs can do a business’s bookkeeping and provide accurate results that help you review and manage the company’s finances and life cycle more effectively.

- Financial consultation: Whether you need help with basic or complex financial matters, CPAs can be a great source of assistance. These professionals can help you establish a more effective budgeting plan, sort out financial risk management issues, make important financial decisions and offer various other financial advice.

- Tax and financial compliance: While CPAs may offer other financial services, they often have extensive knowledge of different tax processes. For this reason, if you are dealing with a tax audit, CPAs may help you reduce the costs by negotiating with the IRS about their findings. Working with a CPA for preventative measures regularly may also help you spot and resolve tax and financial issues before they lead to an audit.

- Tax planning, filing and advice: CPAs have the appropriate knowledge to help you file tax extensions and do year-round recordkeeping. This can come in handy if your tax situation is more complex and you prefer professional advice to avoid potential issues. These professionals can help you prepare and file the relevant tax documents and advise on the most efficient ways to optimize your tax return.

- Payroll: Good payroll processing and management are important for keeping employees satisfied. You would typically need to use payroll management software to ensure everything goes smoothly. CPAs may set your company up with a trustworthy and easy-to-use platform. A CPA may also help you manage your payroll taxes and ensure compliance with the relevant tax laws.

- Forensic accounting: Another instance where CPAs can help you take preventative measures is through forensic accounting. This involves monitoring your books and analyzing your financial habits to detect potential fraudulent acts and prevent financial crimes within the business. They may also inform you about best practices going forward to avoid any close calls.

- Financial business structuring: Whether you want to structure your business as a partnership, LLC, S-Corp or C-Corp, CPAs can help you arrange your business finances in a way that reflects this. They may also help you keep your business and personal finances separate for fewer complications and help you understand your tax liabilities to avoid issues in the future.

When to Reach out to a Tax Attorney

Tax attorneys are best if you have complex tax matters. They may also be necessary for serious situations when you might go to jail for tax evasion or tax fraud, you’re structuring a complex estate plan, or you are having a merger and acquisition. This is because they have critical knowledge of regulations and know how to handle legal challenges with effective strategies. Here are some instances when a tax attorney might be useful to you:

- Legal privilege and confidentiality: Tax lawyers usually have an attorney-client privilege, which protects the client’s sensitive financial information even during legal proceedings. All your discussions and any legal advice shared will also strictly stay between you and your attorney. If you require discretion with your complex tax matters, a tax attorney may be a suitable option.

- Negotiating payment plans and heavy penalties: When tackling harsh penalties or large fees, a tax attorney may help you discover a solution or strategy to reduce the effects. This includes negotiating payment plans with the IRS and looking for ways to maximize credits and deductions.

- Representation in court: If your situation with the IRS leads to a legal case, tax attorneys may defend you in court and help you appeal any choices based on false information or seem unfair. These professionals have a good knowledge of legal processes from experience and know how to argue your case concerning complicated topics.

- Estate and succession planning: Specific tax codes apply to estate planning. Tax attorneys can advise you on the appropriate steps to follow to minimize taxes at the time of inheritance. They can also guide you through complicated processes and understand complex rules.

Factors to Consider in Any Tax Resolution

Above all, one of the most important things to consider when choosing a tax specialist to work with is that their company is reputable and experienced. Here are some key factors you should consider when determining their trustworthiness:

- Experience: Make sure your tax resolution specialist has spent years in the business, and ask them whether they have dealt with similar cases to your own. If they have a lot of experience with various cases like yours and have reached success, they can likely help you develop an effective strategy.

- Credentials: One of the best ways to check a specialist’s reliability is through their licenses and ratings. You can check their website for licensing information or ask them directly. You’ll want to ensure they have credentials from places like Better Business Bureau (BBB). Companies like BC Tax have an A+ rating, verified by a credible third party.

- Transparency: Are they transparent about the entire process, fees and potential results? Honesty shows that a company cares about your situation and wants to make you feel secure. This also makes it easier for you to decide whether the agreement and their service are worthwhile.

Seek Help From Our Tax Resolution Team at BC Tax

While the different types of tax resolution specialists offer tax debt solutions, each offers different resolution strategies. Whether you need assistance with tax audits, levies, unfiled tax returns, penalties or IRS investigation, BC Tax has numerous experienced and knowledgeable tax professionals (EAs, CPAs, and Tax Attorneys) ready to assist.

Our agents will work to understand your situation and form a tax resolution strategy tailored to your unique needs, all with thorough and transparent communication. For sound financial advice and guidance, contact our tax relief experts today.

1-800-548-4639

1-800-548-4639