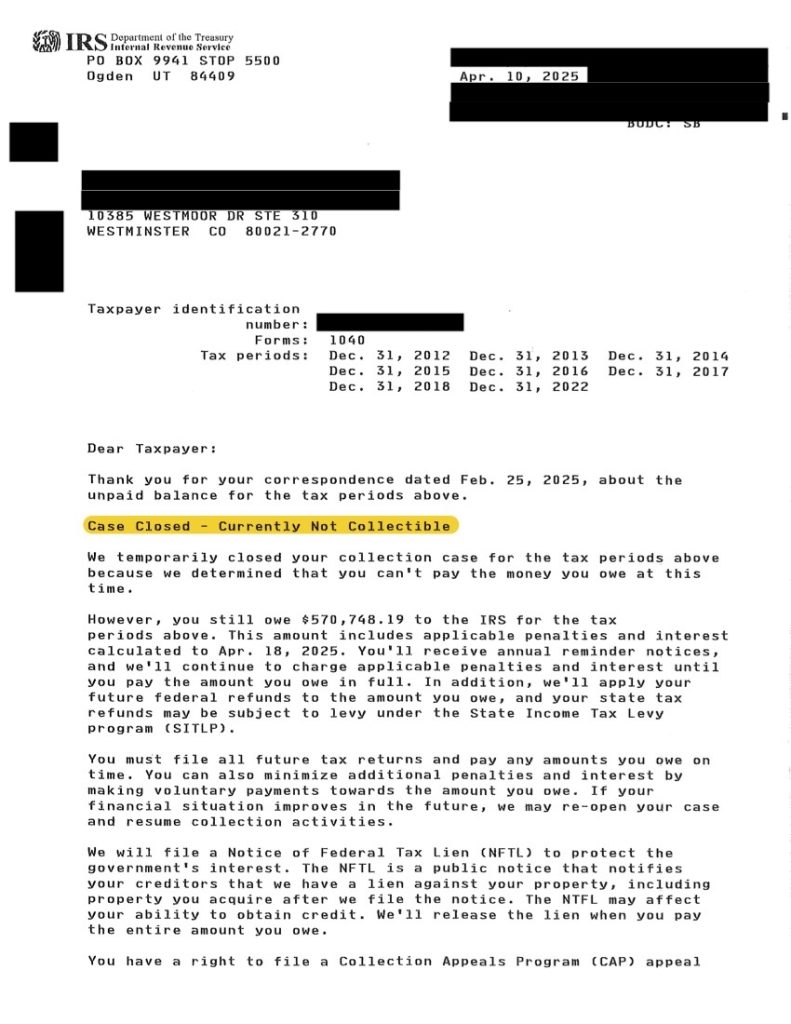

When this client first came to BC Tax, they were facing an overwhelming IRS tax liability of $570,000. Their debt spanned multiple years — from 2012 through 2018, and again in 2022 — and the pressure from the IRS was becoming unmanageable.

After carefully reviewing their financial situation and IRS records, our team determined that the client qualified for Currently Not Collectible (CNC) status. This program is designed for taxpayers who are unable to pay their tax debt without causing financial hardship.

By working directly with the IRS, BC Tax successfully secured CNC status for this client. This meant that all collection activity was halted, including the threat of liens, levies, and wage garnishments. While the balance remains on the books, the IRS has acknowledged the client’s inability to pay and has stopped all enforcement actions.

For this client, CNC status provided much-needed breathing room and peace of mind, allowing them to focus on rebuilding their financial stability without the constant stress of IRS collection efforts.

At BC Tax, we understand that every tax situation is unique. With over 24 years of experience, our licensed tax professionals have helped thousands of clients find real relief — whether through CNC status, installment agreements, penalty abatements, or other IRS programs.

—

👉 If you’re struggling with overwhelming IRS or state tax debt, call BC Tax at 303-867-9933 or schedule a free consultation to learn more about your options.

1-800-548-4639

1-800-548-4639