A recent client of BC Tax was a couple from Pennsylvania who fell behind with the IRS which resulted in a tax lien filed against them for $39,000.00. Unsure of how best to handle the situation, they hired BC Tax to represent them and help navigate the uncertainty they were faced with.

Our professional tax representatives went to work for the client immediately. After a thorough examination and review of the client’s financial well-being, BC Tax found the best course of action to be an Offer in Compromise. An Offer in Compromise allows a tax payer to settle their tax debt for less than the full amount they owe, making it a legitimate option if you can’t pay your full tax liability or doing so creates a financial hardship.

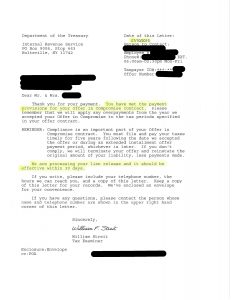

With this client owing almost $39,000.00 but their financial statements showing their ability to pay as only $2,400.00, we submitted an Offer in Compromise along with supporting documentation. After review by the IRS, BC Tax received a letter approving the Offer in Compromise (see below). The team at BC Tax, LLC was able to save this Pennsylvania couple over $36,000.00!

If you have a similar complaint over the amount the IRS says you owe or just need help with your tax debt, please contact BC Tax, LLC at 1-800-548-4639.

1-800-548-4639

1-800-548-4639