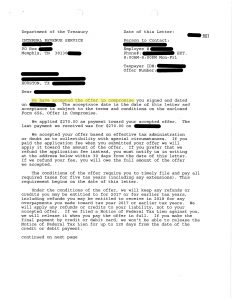

This particular client of ours had an IRS liability stemming from 2006 through 2015 Individual Income Tax that was approximately $66,000. Even though the client had sufficient funds in an investment account to pay the liability in full, the team here at BC Tax went hard to work with the goal to save this client as much as possible. After a thorough analysis of the case and hours of experienced and dedicated work, we were able to successfully negotiate an Effective Tax Administration Offer in Compromise in the amount of $1,350.00; saving them 98% of the original liability, or more simply… $64,000!

See What Others Are Saying About BC Tax

Amanda was amazing she was very patient in explaining the process always promptly returned calls or picked up . She is very Thorough . Professional, empathetic she very knowledgeable She is also very honest and upfront. I would definitely recommend amanda at b c tax. Through the process I didn't feel like she was just my tax consultant I feel like she became a friend.Thank you, Amanda so much.God bless you for all you did.

After years of basically trying to right a wrong with the IRS including trying to get help from DFAS, The Army Headquarters, the IG of the Army and my senator I was unsuccessful in getting the help I needed after 17 years of being acknowledged as a correct concern. So, I sought professional help from BCTax . Megan Bridge was the primary source of help for me and it was superb. I am rnow straight with the IRS and feel like I learned a lot and am a VERRY satisfied customer.

I cannot express enough how grateful I am for Dan Roby and the entire team at BC Tax. I found myself in a very stressful and unusual tax situation, owing over $50,000, and I had no funds to cover it. Despite this, Dan went above and beyond to help guide me through the process. He made sure I understood every step of the way, ensuring that I didn’t get taken advantage of by the IRS or other tax collectors. His expertise, patience, and dedication were truly a blessing during such a challenging time. Thanks to Dan, I feel confident and relieved, knowing I’m in good hands. Highly recommend BC Tax!

1-800-548-4639

1-800-548-4639