This resolution is a perfect example where having a team of experienced tax professionals on your side can help, even when it comes to a seemingly simple payment plan with the IRS.

A recent client who fell behind on five years of their personal IRS 1040 taxes, to the tune of roughly $26,000, found themselves almost ready to accept and agree to a $332 a month payment plan when they decided to seek the help of our tax professionals after a free consultation from our tax consultants who reached out to them one day.

With our team’s years of experience, they knew right away that they could easily lower the monthly payment plan by submitting the proper documents and financial paper work.

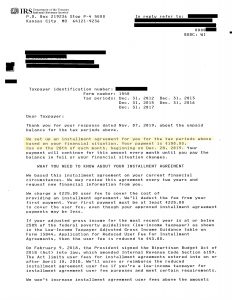

Working together, the client and their team at BC Tax, put together all the proper documents and submitted a proposed Installment Agreement for only $100 a month — which the IRS accepted (see below).

It may not seem like a lot, but we can all agree that having an extra $232 a month can be very comforting with the increasing costs that life throws at us everyday.

If you find yourself having anything to do with the IRS, please take a moment and seek the advise of our experienced professionals. Simply submit your contact info here and we will have someone reach out to you within 24 hours during normal business hours.

1-800-548-4639

1-800-548-4639