One of our more recent successful resolutions included completely removing an audit assessment liability of $83,867 for our client. We were able to do this by negotiating with IRS Audit division as well as by reconciling bookkeeping, receipts, travel logs, and a Quickbooks file the client provided. We worked with the IRS Audit Examiner for roughly 5 months, and ultimately ensured no additional assessments for the 2016 tax year, and prevented the IRS from further auditing the 2015 and 2017 tax years.

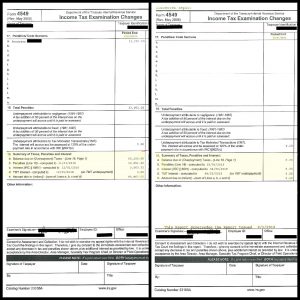

As you can see below, the original audit assessment (left) showed a total liability of $83,867 where as the revised assessment (right) shows a complete removal of all liability with a $0.00 balance.

Contact us for a free evalution if you find yourself struggling with an IRS issue and let us see how we can help you!

1-800-548-4639

1-800-548-4639