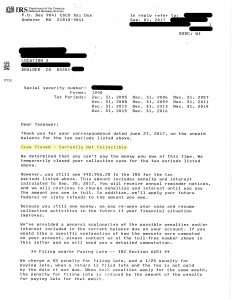

BC Tax was hired in December of 2015 by a client with a tax liability of $80,747.13. Enforced collection actions were successfully held off for over 2 years while the client filed returns and got into filing/deposit requirements compliance with the IRS. After all missing returns were filed and processed with the IRS the clients liability increased to $92,956.28. Knowing the clients asset situation and that the IRS would be very aggressive in trying to collect, BC Tax worked quickly once the missing returns were filed to get the client into a “Currently Not Collectable” status. In the end, this saved our client over $35,000.00 and preserved their 401k for retirement!

BC Tax’s Expertise Helps Client Safeguard 401k and Save Over $35,000

Posted By: BC Tax Insights Team

See What Others Are Saying About BC Tax

Quixote

14:10 21 Oct 25

After years of dealing with IRS letters piling up, I finally decided to contact BC Tax. From day one, they treated me like a person, not a case number. Within a few weeks, they had a clear plan and helped reduce what I owed. I’m honestly relieved.

Lisa Simmons

20:52 02 Oct 25

We needed help with my husbands taxes that have been screwed up for years! I didn’t have the time or the energy to try and fix the issue. I was tired of calling and emailing the IRS with no outcome and continuously getting the run around. I spoke to BC TAX about our issues and they were on it! We now owe NOTHING and they got us some money back. Thank you so much for your time and professionalism, a huge weight has been lifted from us. Much appreciated!!!!

John Dodge

15:03 29 Sep 25

BC Tax, specifically Colleen H. and her team did an incredible job of reducing my substantial tax liability. Needless to say I was overwhelmed, but I was never left wondering what the status of my account was. They communicated with me often and clearly. I can't thank them enough, and strongly recommend BC Tax if you find yourself in need of Tax Resolution and Consultation services.

1-800-548-4639

1-800-548-4639