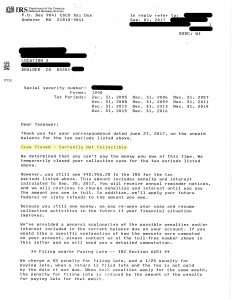

BC Tax was hired in December of 2015 by a client with a tax liability of $80,747.13. Enforced collection actions were successfully held off for over 2 years while the client filed returns and got into filing/deposit requirements compliance with the IRS. After all missing returns were filed and processed with the IRS the clients liability increased to $92,956.28. Knowing the clients asset situation and that the IRS would be very aggressive in trying to collect, BC Tax worked quickly once the missing returns were filed to get the client into a “Currently Not Collectable” status. In the end, this saved our client over $35,000.00 and preserved their 401k for retirement!

See What Others Are Saying About BC Tax

Updated Review on 7/1/2025: I have received an email and a call from Nicole who is now working really hard to get the problems mentioned below settled for my husband and myself. She is going to work directly with the IRS (which is a relief for us). I actually feel more comfortable with her than the rest so I am changing my review to a 5 star.

I stared out working with BC tax and felt like I was getting the help I need. They kept needing more and more money. I finally had things settled and was making the payments as I was suppose to. All of a sudden we get a letter that we owe 2,000.00 because we had not been making the payments. No one told me and I didn't realized that everything had to be in my husband's name. I was making the payment out of my bank account and set up the online IRS login was in my name. Then I get a email after I reached to BS Tax on May 29, 2025 about this and and finally received an email on June 30, 2025 from someone other the person helping me that we were in default and that they needed another 1,500.00 to work on our case. Sorriest customer service I have ever had.

I stared out working with BC tax and felt like I was getting the help I need. They kept needing more and more money. I finally had things settled and was making the payments as I was suppose to. All of a sudden we get a letter that we owe 2,000.00 because we had not been making the payments. No one told me and I didn't realized that everything had to be in my husband's name. I was making the payment out of my bank account and set up the online IRS login was in my name. Then I get a email after I reached to BS Tax on May 29, 2025 about this and and finally received an email on June 30, 2025 from someone other the person helping me that we were in default and that they needed another 1,500.00 to work on our case. Sorriest customer service I have ever had.

Amanda was amazing she was very patient in explaining the process always promptly returned calls or picked up . She is very Thorough . Professional, empathetic she very knowledgeable She is also very honest and upfront. I would definitely recommend amanda at b c tax. Through the process I didn't feel like she was just my tax consultant I feel like she became a friend.Thank you, Amanda so much.God bless you for all you did.

After years of basically trying to right a wrong with the IRS including trying to get help from DFAS, The Army Headquarters, the IG of the Army and my senator I was unsuccessful in getting the help I needed after 17 years of being acknowledged as a correct concern. So, I sought professional help from BCTax . Megan Bridge was the primary source of help for me and it was superb. I am rnow straight with the IRS and feel like I learned a lot and am a VERRY satisfied customer.

1-800-548-4639

1-800-548-4639