When people search online for BC Tax reviews or even BC Tax complaints, they’re often trying to figure out if a tax relief company can really deliver on its promises. At BC Tax, we believe the best way to answer those questions is by sharing real success stories.

One recent case involved a client facing a $114,000 state tax liability. The burden was overwhelming, and like many taxpayers in this situation, the client feared there was no realistic way forward.

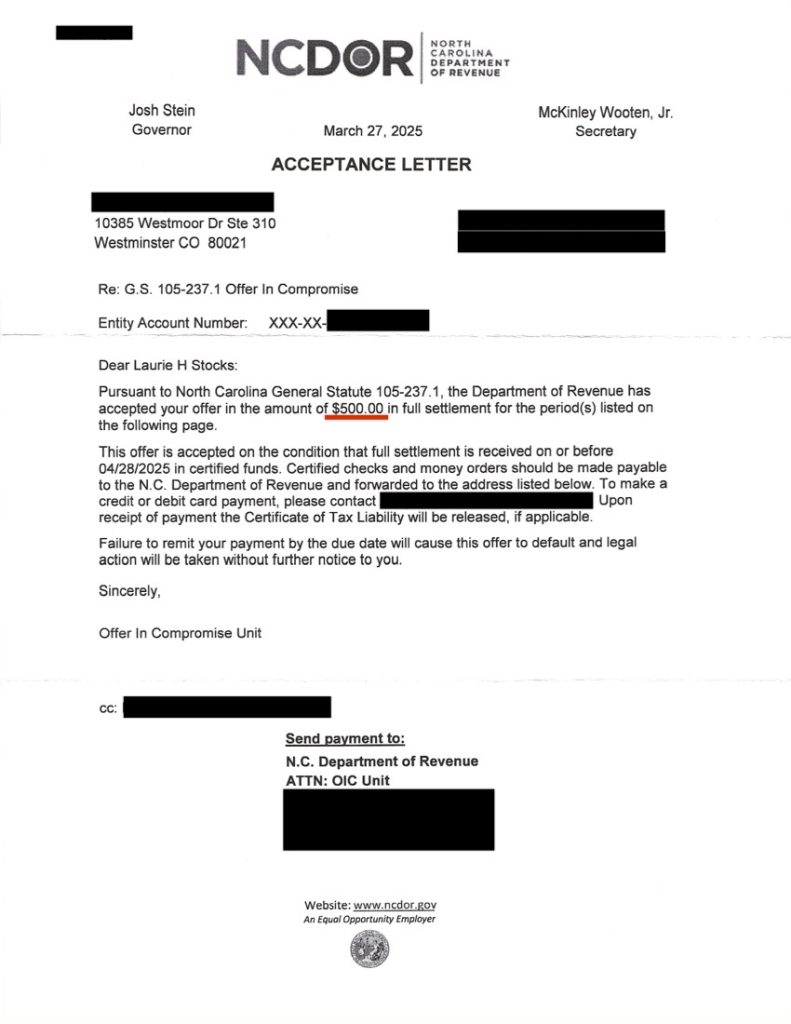

After reviewing their financials, our team determined that the client qualified for an Offer in Compromise (OIC) — a program that allows taxpayers to settle their debt for less than the full amount owed. These programs are extremely rare, especially at the state level, but BC Tax’s experienced negotiators built a strong case and presented it effectively.

The outcome? The client’s $114,000 debt was settled for just $500.

While results like this are not common, they highlight the difference between reading BC Tax reviews online and actually experiencing what our team can achieve. For every concern or BC Tax complaint you may come across, there are success stories like this one — proof of how hard we fight for our clients and the relief we help them secure.

At BC Tax, our 24+ years of experience, A+ BBB rating, and team of professionals allow us to approach complex cases with skill and persistence. Whether it’s an Offer in Compromise, penalty abatement, or stopping wage garnishment, we work to find the best possible solution for each client’s unique situation.

—

👉 If you’re struggling with overwhelming IRS or state tax debt and have been reading BC Tax reviews wondering if relief is possible — let this story be your answer. Call us at 303-867-9933 or fill out the form below to explore your options with a FREE consultation.

1-800-548-4639

1-800-548-4639