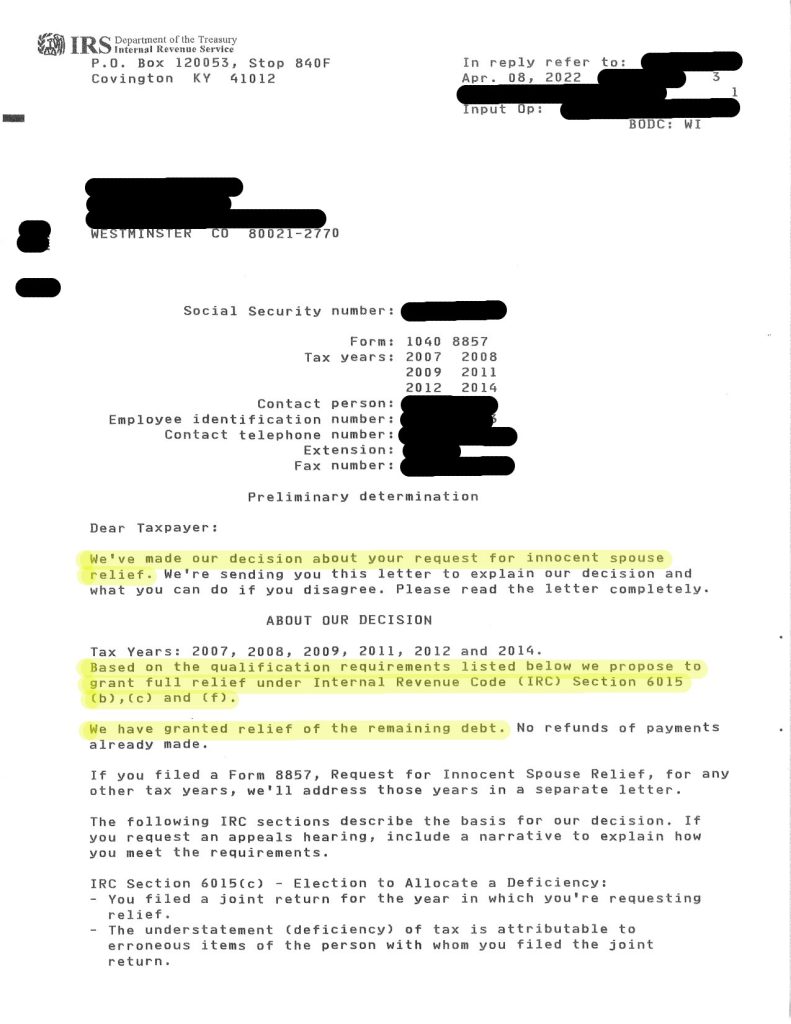

BC Tax, on behalf of our client, was recently able to secure a successful determination for a Request for Innocent Spouse Relief, also known as IRS Form 8857.

Individuals would use IRS Form 8857 to request relief from tax liability, plus related penalties and interest, when they believe only their spouse or former spouse should be held responsible for all or part of the tax.

It is not an easy determination to receive and often times requires substantial amounts of financial records and proof which can take weeks to prepare. Our staff of Tax Professionals have the experience to navigate this difficult course of remediation.

If you believe you may qualify for relief of your tax burden under the IRS’s Innocent Spouse program, please reach out to BC Tax and allow our team of Tax Professionals to help and take on the difficult task of dealing with the federal taxing authority.

How Much Tax Debt Do You Have?

1-800-548-4639

1-800-548-4639