How does a taxpayer owe the IRS over $78,000 but only pay $141 a month?

Through the use of a program with the Internal Revenue Service called Partial Payment Installment Agreement.

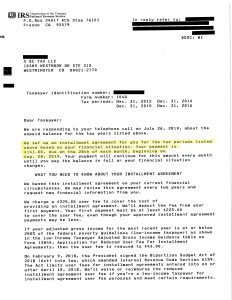

With the representation of a team of tax professionals here at BC Tax, along side the Client, we were able to negotiate an Installment Agreement (aka, payment plan) with the IRS for only $141/month while the Client owed over $78,000. This specific resolution will result in the Client paying just under $18,000 before the statues expire saving them over $60,000.

This Client was extremely pleased with the result and asked us to share their story with others in hopes of helping someone else who may be struggling with back tax debts with the IRS. Please reach out to our team of tax specialists who will provide you a free consultation by calling 800-548-4639 now or sending us a message on our Contact Us page.

1-800-548-4639

1-800-548-4639