As tax season 2024 approaches, it’s essential to get a head start on the recent tax updates from the IRS to ensure you meet all the correct requirements and, most importantly, minimize your tax bill as much as possible. Since our last tax season, there have been many updates, from adjusted tax brackets and 1099-K changes to increased deductions and retirement plan limit changes.

In this guide, we provide all the important adjustments and rules, when to file your taxes and effective tax-saving tips for a successful 2024 tax season.

When to File Taxes for 2024

The specific date to file taxes varies depending on factors like your type of employment and the tax you plan to pay. For example, employers must file W-2 forms by January 31, and independent contractors and the self-employed should submit particular 1099 forms on January 31.

Here are the four primary times to file taxes for 2024 as an employee, retiree, gig worker, self-employed individual or independent contractor:

- First quarter: April 15, 2024

- Second quarter: June 17, 2024

- Third quarter: September 16, 2024

- Fourth quarter: January 15, 2025

Determine Your Tax Bracket

It’s important to understand how tax brackets work, which one applies to you and how it affects your tax rate. Keeping in mind that your tax rate is the percentage of your income that goes toward your taxes, your tax bracket helps you determine what that percentage is depending on a specified income range.

Let’s look at the income tax rates and brackets for 2024:

| Tax Rate | Tax Bracket for Individual Taxpayer | Tax Bracket for Married Couples Filing Jointly |

| 10% | $11,600 or less | $23,200 or less |

| 12% | $11,601-$47,150 | $23,201-$94,300 |

| 22% | $47,151-$100,525 | $94,301-$201,050 |

| 24% | $100,526-$191,950 | $201,051-$383,900 |

| 32% | $191,951-$243,725 | $383,901-$487,450 |

| 35% | $243,726-$609,350 | $487,451-$731,200 |

| 37% | $609,351 or above | $731,201 or above |

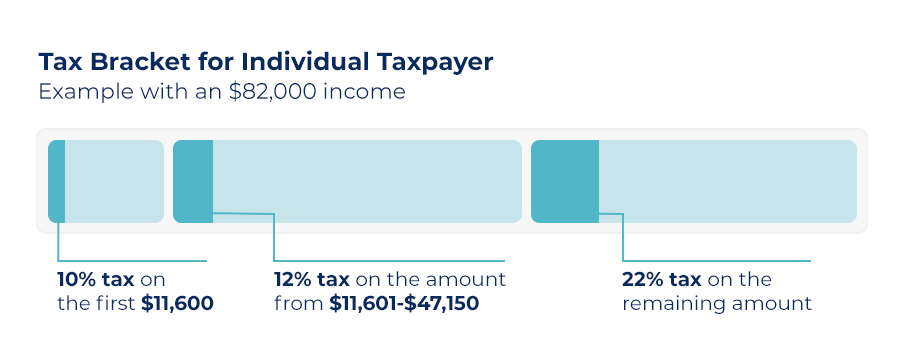

For example, if your income is $82,000, your tax bracket will be in the $47,151-$100,525 income range as a single taxpayer, making your tax rate 22%. While this sounds simple enough, the IRS created these tax brackets in a more complex way than simply applying your tax rate percentage to your entire income.

Instead, the government wants you to lump your income to correspond with the different tax brackets. For example, if your income is $82,000, you will owe 10% on the first $11,600 of your income, 12% of an amount from $11,601-$47,150 and 22% on $47,151-$100,525.

Tax Deductions and Credits to Consider for Tax Season 2024

Tax credits and tax deductions are great ways to reduce the amount of taxes you owe, although they do so in different ways. Tax deductions help lower the portion of income that the IRS can tax, affecting your highest tax bracket percentage.

There are various types of deductions available — some become valid when itemizing your deductions and others may be available even when you take a standard deduction in 2024:

- Medical deduction: Did you have a significant amount of medical expenses? You may be able to qualify for a medical deduction, which allows you to deduct any medical expenses you paid on a dependent, your spouse or yourself if the amount exceeds 7.5% of your adjusted growth income or AGI (income minus any deductions you already qualify for).

- Charitable deduction: If you’ve made any charitable donations, you may deduct them as an itemized deduction. The IRS states that this deduction is usually limited to 60%, although some individuals may deduct qualified contributions up to 100% of their AGI, while businesses may deduct up to 25% of their income tax if it is a qualified contribution. Keep in mind that a qualified contribution must be a cash donation offered to a qualifying organization.

- Business deduction: Self-employed individuals have a range of deductions they can claim if they regularly use their home as a primary place of business. These are self-employed taxpayers with their own businesses rather than employees who work from home. This deduction allows you to claim home office deductions, travel expenses and deductions on any repair, utilities and maintenance expenses.

In contrast, tax credits directly reduce the taxes you owe by subtracting dollar amounts from your tax bill. These come in two forms, namely refundable and nonrefundable. While a refundable credit allows you to receive a refund if the credit is greater than the tax amount you owe, a nonrefundable credit allows you to forfeit any credit if it outweighs the total amount of taxes you owe.

A few tax credits you may want to check to see if you can use this tax season are:

- Earned Income Tax Credit (EITC): This tax credit may be beneficial to low-middle-income households who meet certain AGI qualifications. This will often depend on factors like your income, number of dependents and filing status and may allow you to save either hundreds or thousands of dollars on taxes.

- Child and dependent care credit: Do you have children, grandparents or other dependents you’re taking care of? This nonrefundable credit may allow you to offset a few costs associated with paying for in-home caregiving services, daycare and babysitting services.

- Child tax credit: Here is another credit that allows you to credit costs per dependent child. To qualify, you’ll need to provide information relating to your filing status, the dependent’s date of birth and proof that you can claim them as a dependent.

Upcoming 1099-K Changes

A 1099-K form is specifically for gig workers, independent contractors and self-employed individuals to report any payments or income received relating to their work.

The current rules for 1099-K forms state that it is mainly required if you have made over 200 transactions with third-party businesses that add up to $20,000 or more. These rules will be changing for any 2023 taxes filed in 2024 and all 1099-K taxes filed going forward.

Originally, the IRS sent out this notice in 2021 to apply to tax year 2022. The law planned to implement a new law stating even a single transaction exceeding $600 will prompt the need to file a 1099-K form — allowing taxpayers who own small businesses or have side hustles to track payments more easily.

Even so, due to multiple concerns from taxpayers regarding the timeline of implementing these changes, the IRS decided to delay these plans and put them into effect during 2024 instead. As we wait for the IRS to provide more clarity in the near future, it’s best to keep all your 2023 business receipts and invoices to maintain a good record of products and services related to your business.

There’s a lot to keep in mind when paying taxes using 1099-K, including which income counts and how to report the relevant income. When it comes time to report 1099-K income on January 31, you may benefit from speaking with tax professionals. BC Tax has experienced tax consultants who may assess your unique situation and help you navigate your self-employed taxes with more certainty.

Retirement Plan Adjustments in 2024

There are some interesting changes and adjustments for those with retirement accounts like the various types of IRAs and 401(k)s. Here are a few changes that might affect taxes in 2024.

Limit on Annual Contributions

Some good news is that the IRS has increased retirement plan contribution limits for 2024 due to inflation and the increased cost of living:

- 401(k): While there was a contribution limit of $22,500 in 2023, the IRS bumped up this limit to $23,000 for 2024. This limit will apply to other plans as well, like 403(b), most 457 plans and Thrift Savings Plans. Keep in mind that catch-up contribution limits will remain the same in 2024 at $7,500.

- IRA: You can expect IRA contribution limits to increase from $6,500 in 2023 to $7,000 in 2024. Catch-up contributions for people who are 50 and older will remain at a limit of $1,000 for 2024.

Deduction Limit Increases for Traditional IRA Contributions

The IRS has made adjustments to phase-out limits for deducting standard IRA contributions. As a refresher, phase-out limits refer to the lowering of your deductions as your income rises. Here are the new phase-out ranges that will apply to taxpayers with or without retirement accounts in 2024:

- Single taxpayers with a retirement plan: This phase-out range has increased from between $73,000 and $83,000 to between $77,000 and $87,000.

- Married couples with a retirement plan filing jointly: Previously, the phase-out range was between $116,000 and $136,000. Now, this amount has increased to between $123,000 and $143,000.

- Married to a taxpayer who has a retirement plan and filing jointly: If you are without a retirement plan and your spouse is covered by one, your joint filing range will be between $230,000 and $240,000, which is an improvement compared to the 2023 amount of between $218,000 and $228,000.

- Married and filing separately: If you’re filing separately and have a retirement plan, your phase-out range will remain between $0 and $10,000.

Income Limit Changes to Roth IRA Contributions

There are also new phase-out ranges for taxpayers who want to make contributions to their Roth IRA account:

- Single taxpayers and head of the household: $146,000 and $161,000

- Married couples filing jointly: $230,000 and $240,000

- Married couples filing separately: $0 and $10,000

Tax Saving Tips for Filing Your 2024 Tax Return

With all the important considerations for tax season 2024, you’ll need good end-of-year tax planning to avoid any unnecessary penalties and missed opportunities. Here are some exciting tax-saving tips to help support a smooth tax filing process.

1. Make Estimated Tax Payments

Do you have a significant amount of income that may not be subject to withholding (i.e. income tax self-employed individuals or employers give directly to the government as a payer of the income rather than a recipient) such as capital gains, interest or dividends? If so, you’ll likely have to meet pay-as-you-go requirements by making estimated tax payments.

It’s essential to avoid underpayments so you can negate any penalties associated with an inability to withhold enough taxes from your income. Fortunately, the IRS provides a form with detailed instructions on how to determine if you should make estimated payments and an estimation tool to calculate the amount you should withhold.

2. Get Professional Help

If you find yourself wandering the web for effective tax-saving tips, it might be time to consider working with a trusted tax professional. A tax consultant at BC Tax can help you understand all the complexities of your tax situation and provide personalized advice for avoiding mistakes and maximizing your deductions. Speaking with a tax consultant to simplify your options can help reduce any potential headaches.

3. Plan Ahead

Planning ahead of time may help you reduce stress and minimize your tax bill for 2024. For instance, once you complete your form, you can speak with your tax consultant or look around for ways to increase your deductions with charitable donations and retirement contributions. You can also take another look at your withholdings to ensure you’re close enough to the correct amount so that you can avoid needing to offer the IRS underpayment penalties or waiting for a tax refund in 2024.

4. Organize Your Income Documents

To ensure you have everything needed to begin your tax preparation process, gathering and organizing your income documents is an essential first step. Doing this can help you take a weight off your shoulders knowing you have all the necessary documents at hand.

Collect the relevant 1099 forms for any side jobs you handled, make sure you receive your W-2 from your employer and gather all other income documents the IRS expects from you. Also, make sure to collect your pay stub and any other receipts that will help you provide an accurate tax report. Keep these documents in a safe place and make digital copies to avoid losing them.

5. Make Tax-Efficient Investments

Need to reduce your tax bill for 2024? There are some smart ways you can avoid taxes on certain amounts or even put them off through investments. You may even be able to reduce your tax bracket with the correct investment.

For example, you might create a tax-deferred account such as a 401(k) or IRA, which will allow you to defer income tax and investment gains until you withdraw your money years later. Tax-exempt investments like municipal bonds may also be excellent ways to be exempt from federal income tax.

Do Your End-of-Year Tax Planning With BC Tax

With tax season 2024 right around the corner and so many new guidelines, utilizing proper tax-planning strategies can help streamline the process and save money. The key is understanding your tax bracket, deduction and credit options, and shortcuts to postponing tax on certain amounts.

Whether you need help exploring your options, determining your 2024 tax bracket or avoiding penalties, the qualified tax consultants at BC Tax are ready to help. BC Tax is a tax consultancy agency that offers free consultation in particular areas. We also help with tax preparation, tax resolution and reducing tax debt.

For more tax tips, contact our experts today or call us at 1-800-548-4639 for personalized tax consultation services.

1-800-548-4639

1-800-548-4639