What Are Enrolled Tax Agents?

For many Americans, tax season comes with a bit of stress and lots of questions. Fortunately, with the right tax agent on your side, taxes don’t need to be stressful. An enrolled tax agent can help you with proper tax planning so you can potentially receive a larger refund or reduce your tax burden.

Without the insight of an expert, you can miss tax benefits and pay more than you need to come tax time. If you are a taxpayer who is dealing with complicated taxes or you owe back taxes, you may want to work with an enrolled tax agent.

What Are Enrolled Agents Services?

Enrolled tax agents have the privilege to represent taxpayers before the IRS. Enrolled agents accomplish this in one of two ways:

- Working as a previous IRS employee, during which they interpreted and applied the tax code.

- Passing a comprehensive three-part IRS test that covers business and individual tax returns and rules.

Those who apply to be an enrolled agent need to pass a background check. During this process, someone who has not paid or filed taxes in the past may be denied enrollment. The status of enrolled agent is the highest credential awarded by the IRS. When an individual obtains this status, they must meet ethical standards and complete continuing education courses.

Unlimited Practice Rights

An enrolled agent has unlimited practice rights, meaning they are not restricted on the types of tax issues they can handle and which taxpayers they can assist. At BC Tax, our enrolled agents can help you solve a variety of tax issues, such as:

- Resolving back taxes

- Stopping enforced collection efforts

- Fighting liens and penalties

- Filing accurate and updated returns

- Providing tax solutions and defense

Tax Planning Services

An enrolled agent offers clients tax planning services, which involve an analysis of your financial circumstances that may reduce your tax liability. Depending on your situation, this can result in a higher return at the end of the tax season. There are four basic kinds of tax planning:

- Small business

- Federal income

- Retirement

- Estate

For any individual’s or business’s financial plan and budget, tax planning is crucial. When you are able to properly plan for your taxes, you can understand the benefits you may be eligible to receive. An enrolled agent may help you take advantage of the following:

- Tax credits: A tax credit lets you subtract from your total tax liability. You may be eligible for a tax credit, for example, if you have children, you are a low-income family or you are a student.

- Tax exemptions: A tax exemption eliminates or reduces your responsibility to pay. Exemptions related to dependents permit you to reduce your tax liability by a set amount for every child or other dependent you have.

- Tax deductions: A tax deduction allows you to minimize your taxable income. Deductions typically come from expenses you incurred during the year and are subtracted from your total annual income. An example of a deduction is a charitable donation.

- Tax concessions: Tax concessions refer to government reductions for the amount of taxes owed by certain groups of people. A concession is typically used to encourage behaviors.

- Tax rebates: A rebate is a type of refund that takes place following a retroactive tax decrease. Sometimes, the federal government will offer rebates to stimulate the economy in a financial recession. Rebates may also be used to incentivize practices that are environmentally friendly.

Without tax planning, you could end up paying more than you need to in taxes, making having an enrolled agent on your side valuable.

Tax Preparation And Planning Help

Enrolled Agents vs. CPAs

When you are looking for a professional who can handle your taxes, you can choose between an enrolled agent and a certified public accountant (CPA). Both are tax preparers, but what is the difference between an enrolled agent and a CPA?

One difference is in how each of these tax professionals is licensed. While enrolled tax agents are licensed by the IRS at the federal level, CPAs are licensed by state boards of accountancy. For CPAs, the requirements for becoming credentialed vary by jurisdiction or state. A CPA typically must complete college or university studies in accounting, meet the experience requirements and complete an exam known as the Uniform CPA Exam.

A CPA studies tax issues and gains experience in accounting matters like auditing and financial planning, and they can help you prepare your tax return. Like enrolled agents, CPAs also have nearly unlimited practice rights under the IRS, which are given only to:

- CPAs

- Enrolled agents

- Lawyers

Though other kinds of tax professionals are certified through the IRS, such as registered tax return preparers and enrolled actuaries, their rights to practice are limited. CPAs can also represent you in front of any IRS office and are required to meet ethical requirements.

Enrolled Agent Requirements

An enrolled agent is authorized to represent individuals, businesses and organizations to the IRS and can handle any tax issue at the federal level. With that authorization comes requirements they must follow to continue representing clients in tax dealings.

Requirements for Continuing Education

An enrolled agent is required to participate in continuing education courses to keep updated on changes in tax law. Enrolled agents must participate in at least 72 hours of credit for continuing education, which includes six hours of professional conduct or ethics. They need to complete this education every enrollment cycle.

For an enrolled agent’s enrollment year, there is a requirement for at least 16 hours of credit for continuing education. This education includes two hours of professional conduct or ethics and needs to be completed every enrollment year during the enrollment cycle.

Requirements for Ethical Standards

Under federal law, anyone who practices before the Treasury, including the IRS, must have a good reputation and good character. Additionally, they must have the necessary skills and knowledge to handle tax matters. After becoming certified, an enrolled agent may be suspended or lose the right to practice for any of the following reasons:

- Threatening or misleading a client with the intention of defrauding

- Disreputable conduct like committing a crime

- Willfully violating tax regulations or laws

- Incompetence

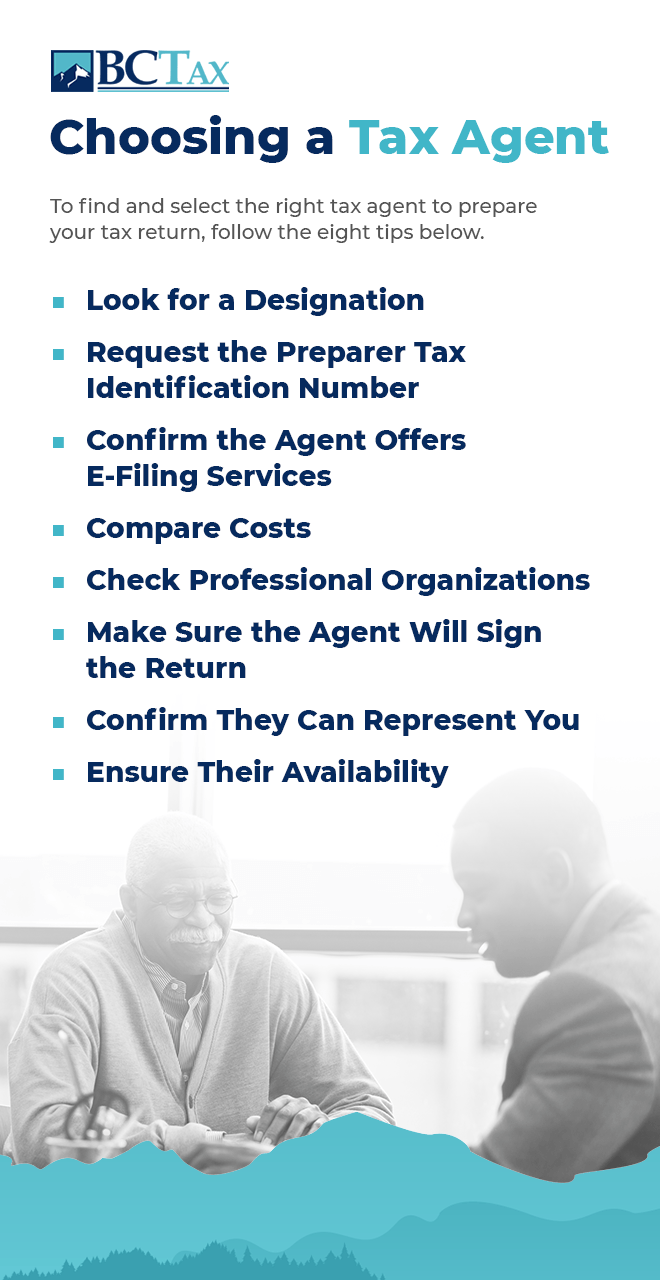

Choosing a Tax Agent

Many Americans choose to work with tax advisors or preparers to file their tax returns, but few know how to select the best tax agent. To find and select the right tax agent to prepare your tax return, follow the eight tips below.

1. Look for a Designation

If someone is an enrolled tax agent, they will advertise their status as such with the “EA” designation. You can find enrolled tax agents in professional directories and online. If you are uncertain about an enrolled agent’s status, you can check with the IRS. CPAs and licensed attorneys who are credentialed tax preparers will also have designations that indicate their status.

2. Request the Preparer Tax Identification Number

Anyone who assists in preparing a federal tax return in exchange for compensation is required by the IRS to have a preparer tax identification number (PTIN). If a tax preparer is a volunteer, there will not be a PTIN, as they are not performing the work for compensation. Ensure your tax preparer will put their PTIN on your tax return, as the IRS requires the number on your return.

3. Confirm the Agent Offers E-Filing Services

If a paid preparer completes several tax returns for clients, the IRS mandates that they must file electronically through the IRS e-file system. If you find a tax preparer who does not offer e-filing, this may be a sign that they are not doing much tax preparation and may not be someone you want to trust with your return.

4. Compare Costs

Next, compare the fees that the agent charges to what similarly qualified agents charge. Many tax preparers charge a minimum fee, plus an additional cost depending on the complexity of your tax return. Alternatively, some tax preparers charge a fee for every form and schedule that must be completed for your return.

If a tax preparer bases their fee on the amount of your refund or claims they can help you receive a bigger refund than someone else, this can be a red flag.

5. Check Professional Organizations

An agent’s membership in a professional organization can be a good indicator of their qualifications and conduct. Many professional organizations have various certification programs, professional conduct requirements and codes of ethics. A tax agent may have membership in any of the following organizations:

- The American Academy of Attorney CPAs (AAA-CPA)

- The National Association of Tax Professionals (NATP)

- The National Association of Enrolled Agents (NAEA)

- The American Institute of Certified Public Accountants (AICPA)

6. Make Sure the Agent Will Sign the Return

When you choose a tax agent, ensure that, along with providing their PTIN, they will sign your return. You also should not sign a blank return, as a tax preparer could then put any information on the return, such as their own bank account number. If this happens, they could steal your refund. Be wary of any tax preparer who asks you to sign a blank return.

7. Confirm They Can Represent You

An enrolled agent with a PTIN can represent you on audits, collection issues, payments and appeals in front of the IRS. A tax preparer who only has a PTIN cannot represent you for these issues, even if they completed your tax return.

8. Ensure Their Availability

Finally, you want to work with a tax preparer who is available to answer your questions and address your concerns when they arise. Even after you have filed your return and the tax season is over, the best tax preparer will respond to your emails, take your calls and meet with you as needed.

The right enrolled agent will understand the importance of taxes to your personal finances and will be happy to make any necessary clarifications or give further explanations.

Why Work With an Enrolled Agent at BC Tax

At BC Tax, we strive to reduce our clients’ stress and tax debt. Over our years in the industry, we have helped thousands of businesses and individuals handle their tax problems. Our various tax debt solutions can help address your tax concerns. One of our dedicated enrolled agents will guide you through every step of the entire process and keep you informed along the way so you will always know your tax return’s status.

When you work with us, you will have a team of experts on your side who can address your tax concerns. We can offer you the following benefits when you choose BC Tax:

- Solutions to tax issues: If you have a tax issue, such as owing back taxes, our tax planning services can help you find a solution and address your concerns.

- Comprehensive knowledge: All of our agents are trained experts who understand federal and state taxes. We do not outsource our work to third parties who do not understand the IRS, so you can rest assured that your return is being completed by a knowledgeable professional.

- Flexible hours: Though we are based in Denver, you do not need to worry about time zones with us at BC Tax. You can communicate with one of our enrolled agents during the times that are most convenient for you.

- In-person interaction: We know how personal tax issues can be, and we understand that it can bring you peace of mind to meet with your tax agent in person. You can schedule an appointment with us to visit our offices in person and discuss your tax situation with one of our agents.

Contact Us at BC Tax

At BC Tax, our enrolled tax agents can provide the tax services you need. When you choose us, you will have a consultation with one of our tax consultants who will get the best picture of your tax issue and what led to your situation. The tax consultant will ask you several questions, such as:

- Are all your tax returns filed?

- How many years are involved in your tax liability?

- What has the dialogue been like between you and the taxing authority?

- Has the taxing authority already taken aggressive collection steps like a levy or garnishment?

We can provide you with the most accurate quote possible based on your circumstances and the scope of work. If you would like to receive a free, no-obligation consultation, contact us at BC Tax today.

1-800-548-4639

1-800-548-4639