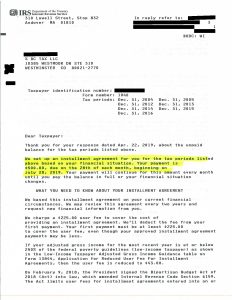

Here is yet another example of a successful outcome for a client of BC Tax. This client had numerous past due balances with the IRS dating back from 2004 through 2016. The total amount this client owed was close to $98,000.

The IRS began to initiate collection actions against the client by;

1. Filing tax liens against the client

-and-

2. Sending individual notices requesting full payment of each individual tax year.

The amount of notices from the IRS soon became very confusing and overwhelming for the client, at which point they hired BC Tax for assistance. The team of tax professionals here at BC Tax began working one-on-one with the client to build a full and comprehensive strategy for the client’s specific financial situation. The solution was a Partial Payment Installment Agreement in the amount of only $500/month. The client now has a regular structured payment which allowed the removal of the tax liens that were filed and halted all other collection actions. With this solution in place, and after the limitation for collection on past tax years expires, the client will end up paying significantly less than the original amount owed!

1-800-548-4639

1-800-548-4639